Electronic payments that are processed within seconds and credited from one bank to another, without an intermediary, are instant payments.

Checks, RTGS, EFT/ACH, cards had their concerns related to delays, frauds, AML check, batch processing delay, hidden charges, etc. Some could not handle Peer2Peer transactions.

Instant payments have low cost, high speed, support P2P and are always available.

The popular ones are UPI/ IMPS (India), RTP (USA), Faster payments (UK), SEPA IC (Europe).

UPI was started in 2016. And it allows not just interbank transactions but also Person2Merchant ones. A virtual address, QR code, Pull Pay (R2P) are the critical features of UPI.

UPI payment address:

All payment addresses are denoted as account@provider

- Universal:

- account_number@bank_name_IFSC_code.npci

- aadhar_number@aadhaar.npci

- mobile_number@mobile.npci

- Unique to India:

- user@my_psp

Bit more on the PSPs:

- Acquire new customers

- Facilitate payments

- Provide front end or mobile app to customer

- They can be bank or 3rd part fin tech partner (BHIM, googlepay, amazonpay, phonepe)

- One customer’s bank account can have multiple UPI apps.

- One PSP can tie up with multiple banks for the issuance of PSP VPA handles. Eg: google pay has tied up with 4 banks; @okaxis, @okicici, @okhdfcbank, @oksbi

UPI Framework consists of:

- Acquiring channel for UPI application (payment request)

- Payer PSP

- Remitter bank (debit request)

- Payee PSP (authorization and mapping request)

- Beneficiary bank (credit)

- NPCI

Typical flow from the user perspective is:

- Payer sends request to Payer Bank

- Payer Bank validates (and verifies settlement later). Then sends the request to Instant Payment System. Who sends it to Beneficiary Bank.

- Beneficiary Bank sends update to Beneficiary. And sends a confirmation of execution to Payment System who then sends it to Payer Bank.

- Payer Bank sends status to Payer.

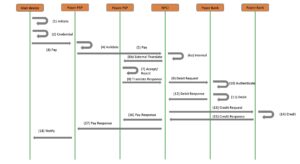

Typical flow system flow perspective is:

UPI settlement process illustration:

Case- 10 transactions 1,00,000 from Bank A to Bank B. And 5 transactions 30,000 from Bank B to Bank A.

- NPCI sends request to RBI to Dr Bank A for 70000 and credit Bank B for 70000

- NPCI sends settlement report to Bank A; it Cr Nostro RTGS (shadow mirror a/c) and Db UPI GL

- NPCI sends settlement report to Bank B; it Db Nostro RTGS (shadow mirror a/c) and Cr UPI GL

- Both banks hold RTGS settlement with RBI, 1st call is for Cr Remitter and Cr UPI GL, 2nd call is Cr Beneficiary and Db UPI GL

Settlement happens multiple times a day and is a case of nett deferred settlement.

UPI customer registration:

- Download app

- PSP Mobile App has 2 components: PSP Mobile App functionality + NPCI SDK (library. Embedded within the app. It encrypts the UPI PIN and sends it to NPCI)

- Customer registration

- Outbound SMS and Hard-binding (device finger printing). Out bound SMS is sent from the selected SIM card to the PSP; who gets mobile number, finger print details like device id, App Id, IMEI number.

- Add bank account

- Customer selects the bank form the list

- PSP forms a request to NPCI with the mobile#

- NPCI forwards the request to the Issuer bank

- Bank retrieves account numbers linked to the mobile#

- Bank passes it back to NPCI

- NPCI passes it to PSP; who stores bank + ifsc wrt mobile# and device info

- List of account # are shown to be selected from the app

- PSP creates unique VPA for that customer for that bank for that account number

- Generate UPI PIN

- Customer selects “generate PIN” option

- PSP requests OTP for that customer account

- NPCI requests the Issuer bank for OTP generation request

- Issuer bank generates OTP and send to customer

- Customer then enters debit card #, expiry date, OTP

- PSP forwards the OTP validation request

- UPI decrypts the details (including PIN) and encrypts with Issuer key

- Issuer bank decrypts the data and validates the details and OTP. And saves the PIN.

Responsibilities of the parties:

- Payer PSP

- Onboard new customer

- Create her/ his UPI ID

- Create device binding

- Payee PSP

- Onboard customer/ merchant

- Facilitate money transfer/ payment to recipient using UPI

- Remitter Issuer bank

- Hold and debit bank account for transaction

- Store and verify UPI PIN

- Beneficiary bank

- Process incoming credits and funds into beneficiary account

What you’ve written here is not just insightful — it’s comforting. There’s a warmth to your words that makes the reader feel seen and understood, as though you’re sharing something deeply personal and valuable. This is the kind of writing that stays with you long after you’ve finished reading it.